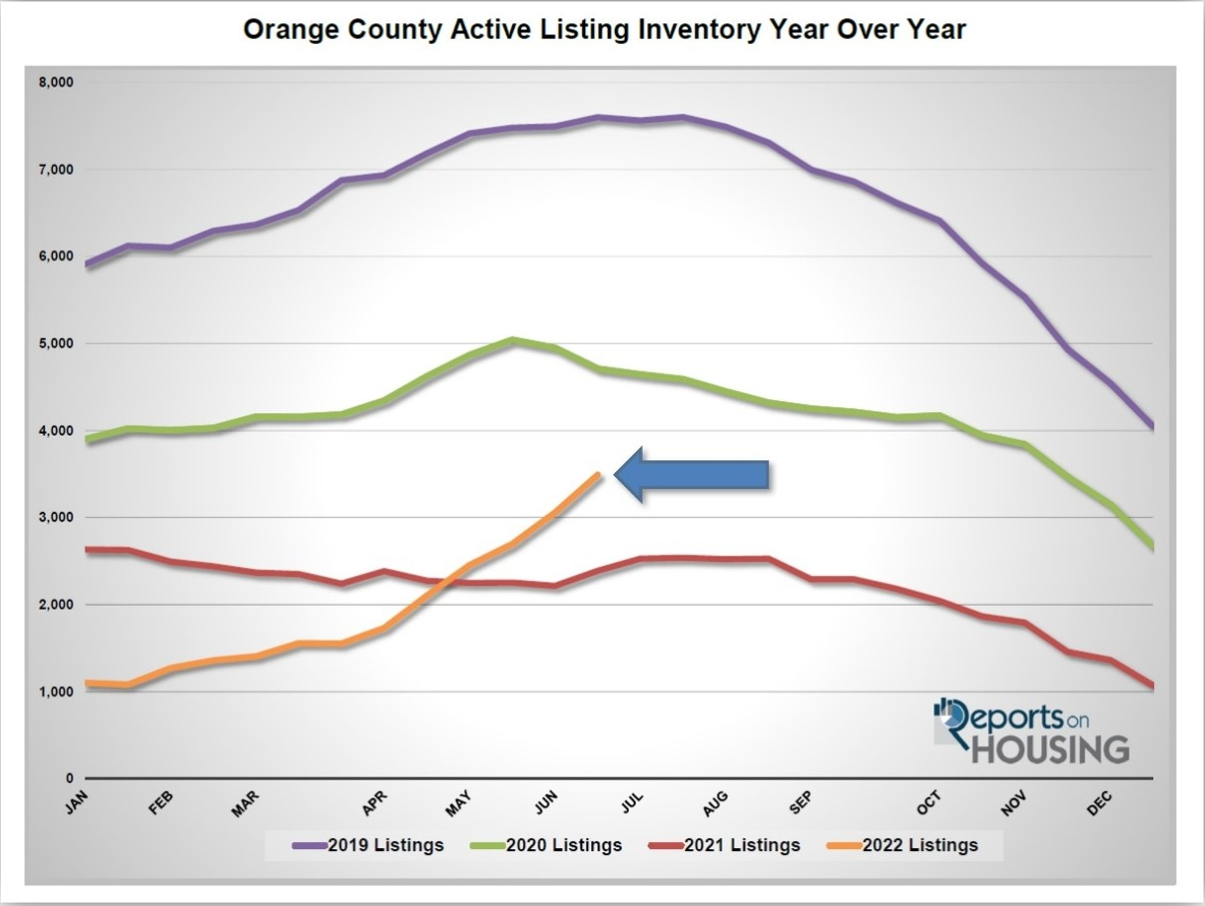

Yes, supply is rising. Demand is muted. The housing market is slowing. The number of offers received is dropping. The number of offers over the asking price is falling. Sales are down. The number of price reductions has been steadily climbing. The pace of housing, the Expected Market Time (the amount of time between hammering in the FOR-SALE sign to opening escrow) has slipped from an Insane Seller’s Market (less than 40 days) in March when it was at 19 days to a Hot Seller’s Market (between 40 and 60 days) today at 56 days. It is about to slip into a Slight Seller’s Market (from 60 to 90 days). Later this year it will decelerate to a Balanced Market (between 90 and 120 days), a market that does not favor buyers or sellers. And, if mortgage rates remain elevated above 5.5% with duration, it will most likely become a Slight Buyer’s Market (between 120 and 150 days) by year’s end. Yet, in 2007, the Expected Market Time surpassed 400 days in Orange County, a Deep Buyer’s Market (over 150 days), when home values sank.

Even if housing were to slip into a Slight Buyer’s Market, it would have to be at those levels for months before prices start to decline. And any declines would be small. There is a real stickiness to home values. Very few sellers really “have to” sell. Homeowners are in a very strong position with plenty of equity, low mortgage rates, high credit scores, good jobs, and money in the bank. There will be no reason to panic. Values will not plunge.