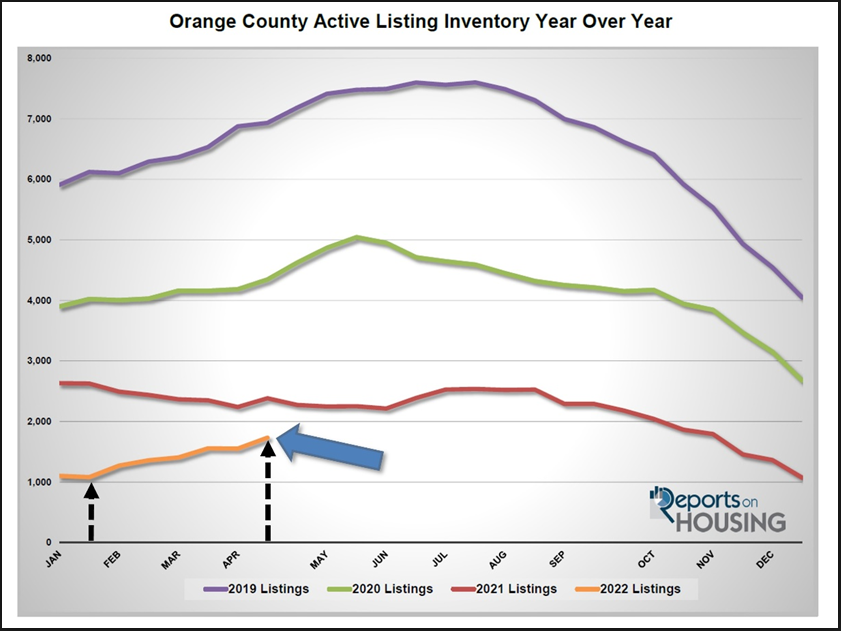

The active listing inventory added 180 homes in the past couple of weeks, up 12%, and now sits at 1,732 homes, still its lowest level for this time of year since tracking began in 2004. Yet, this is the first year since 2019 that the inventory is methodically rising. With a major spike in mortgage rates, demand has cooled. Homes that are priced well and in good condition will fly off the market. Homes that are overpriced, in poor condition, or have an inferior location will accumulate on the market allowing the active inventory to continue to grow. There are more OPEN HOUSE directional arrows at intersections, another barometer indicating that homes are beginning to take a bit longer to sell. Expect the inventory to continue to surge upward. Normally it peaks during the summer months, prior to the kids going back to school. But, due to higher mortgage rates, anticipate a delayed peak that occurs between October and November as many homes sit without success.

Last year, the inventory was at 2,384, 38% higher, or an additional 652 homes. The biggest complaint last year was that there were not enough homes on the market, yet there were more homes available compared to today. The 3-year average prior to COVID (2017 through 2019) is 5,780, an extra 4,048 homes, or 234% more, more than triple today. There were a lot more choices back then, though this is slowly changing.

For the first couple of weeks of April, there were 1,563 new FOR-SALE signs in Orange County, 476 fewer than the 3-year average from 2017 to 2019, 23% less. Every single missing sign counters the potential rise in inventory due to higher mortgage rates.